7 Chapter 7: Conducting Market Research

Chapter 7: Conducting Market Research

As an entrepreneur, before you can make key decisions about your venture, you need to roll up your sleeves and do some research. Opportunity screening is the initial process by which entrepreneurs evaluate innovative product ideas, strategies, and marketing trends. Focusing on the viability of financial resources, the skills of the entrepreneurial team, and the competition, this screening helps determine the potential for success in pursuing the idea and can help refine planning.

Having a clear picture of what your target market is and what it wants is critical in entrepreneurship. To that end, entrepreneurs typically conduct market research to guide their decision making. On a basic level, market research is the collection and analysis of data related to a business’s target market. Market research can entail everything from gathering information on competitors’ products to the interpretation of demographic data related to potential customers. The main purpose of market research is to gain a deeper understanding of customer needs and wants as well as the potential market for a product/service.

Imagine that you are creating a cosmetic line that is organic, contains age-defying vitamins and minerals, and is easy to apply. You might hypothesize that your target market is professional women who are interested in high-quality beauty products that are not harmful to themselves or the environment. But imagine that after conducting extensive market research, you learn that women aged eighteen to forty-five years tend to be interested in the benefits that your product line provides, but that women over fifty years of age are not. In light of these findings, you can either adjust your line’s benefits to serve the market you initially wanted to serve (professional women), or you can cater to the needs of a smaller audience (eighteen to forty-five-year-old women).

A good exercise for better understanding your target market is to detail the everyday life of your ideal customer. You can do this by describing in detail a set of possible customers who would buy your product. Details could include demographic information such as gender, age, income, education, ethnicity, social class, location, and life cycle. Other information that would be helpful would include psychographics (activities, hobbies, interests, and lifestyles) as well as behavior (how often they use a product or how they feel about it). The better you know your ideal customer, the better you can focus on capturing their attention by matching their preferences with your offerings.

Market research also helps you understand who your competitors are and how they serve the target market you want to engage. The more you know about your competition, the easier it will be to determine and differentiate your offerings. Let’s dive into how marketers gather all these data and the value the data provide to entrepreneurs.

Primary Market Research

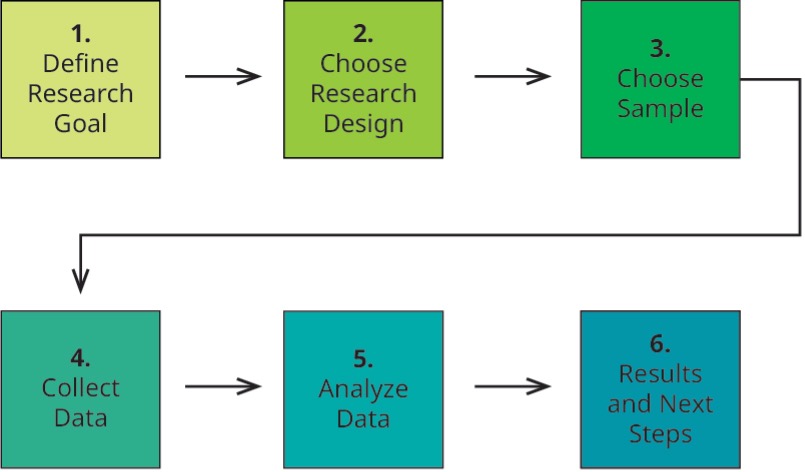

Primary research entails collecting new data for the purpose of answering a specific question or set of questions. While conducting your own research can be resource intense, it is also the best way to get answers specific to your business and products, especially if you want to penetrate niche markets that have not been studied. It also allows you to get specific. By asking the right questions, you can determine people’s feelings and attitudes toward your brand, whether they like your product design, whether they value its proposed benefits, and whether they think it is priced fairly. Figure 7.1 shows the steps common in conducting primary market research.

Figure 7.1 Primary Research Process

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Define the Research Goal

You should start by defining the goal of your research project. What are you trying to find out? Do you want to know more about your target market, their preferences, lifestyle choices, and culture, or do you want to know more about your competitors and why your target market buys from them? What are your criteria for validation of the research goal or goals?

The more time you take to clarify your research questions, the more likely you will be to achieve your research goals. If you can’t figure out exactly what you’re looking for, that’s okay. Exploratory research using a focus group can help you decide what kind of research questions to ask. A focus group is a gathering of people, typically six to twelve participants, who come together to discuss a topic presented by a moderator, who usually poses questions and collects qualitative data that can be used to answer questions or define research further.

For example, a manufacturer of water bottles might know there is a problem with their products as sales have been declining over time. The company doesn’t know exactly why or where to start, so it would use a focus group to better define the research goal or problem. Using focus groups, they might find out that they are targeting the wrong segment or that there is a need for better water bottle designs. Talking to the focus group can uncover possible research questions to undertake.

Determine Research Design

The next step is to determine which research techniques will most effectively help you answer your questions. Considering what you want to learn and determining what your budget is will help you decide if qualitative or quantitative research best suits your needs. Well-designed research projects often use some combination of both.

Qualitative research uses open-ended techniques such as observation, focus groups, and interviews to gain an understanding of customers’ basic reasons, opinions, and motivations. Simply observing potential customers, whether at a store or in daily activities, and noting their behaviors are a simple, effective form of ethnographic research that can help you better understand the lifestyles and habits of potential customers. Ethnographic research includes the personal observations of the subject by being immersed in the subject’s environment. Research like this helps companies see how people use their product over the course of a day.

For example, if you manufactured a water bottle and wanted to design a “better” water bottle, you could watch how people use their water bottles while working, exercising, during their commute, and so on to better understand their needs and habits. This ethnographic research can often uncover latent, or unstated, needs that you can use to build your concept. Unstated needs refer to those that are expected from a company, such as a certain level of quality or good customer service. These are default expectations that a customer has based on their experience with products in general.

Employing a mystery shopper, or pretending to be one yourself, is another way to learn how customers and employees act within a specific retail environment. A mystery shopper is a person who has been hired by the company or a third party to pose as a real shopper and has gone undercover with a specific goal of testing certain aspects of a business. This can take the form of purchasing a product, browsing and asking questions of an employee, interacting with other customers, or simply observing what is happening inside the store. After the experience, this person will provide feedback to the company.

Focus groups and one-on-one interviews can be useful to obtain more thoughtful answers and explore debatable topics. Both are good methods for digging deeper into the specific motivations and concerns of people, especially as they pertain to personal, privately held beliefs. This research is useful when trying to develop a more novel product, but you must do your best to eliminate “support bias” in that the panelists might seem favorable to new concepts to please or accommodate the moderator. For one-on-one interviews, it is important to develop a thorough interview or discussion guide, so other team members can also conduct the interviews. By doing this, you will ensure a consistent approach to asking key questions and documenting responses to help guide the next step of the development of your product.

Quantitative research focuses on the generation of numerical data that can be turned into usable statistics. This kind of research most often takes the form of surveys or questionnaires that pose multiple-choice questions with predefined answers. While these surveys do not allow for much free expression on the part of the participant, the focused nature of the answers means entrepreneurs can identify trends, such as which social media platforms are preferred by customers or potential customers. For example, they may find that Instagram is the most used social media app because of its ease of use and its ability to incite emotional responses to pictures. Sample survey questions can be anything from “How many times have you gone to the grocery store this week?” to “Which age range do you belong in?” This kind of approach is an efficient way to collect a lot of data because once the survey is written, it can be distributed in person or online to as many participants as you like. Typically, the more people you survey, the more accurately your data will reflect the demographic you are examining.

Another way to generate quantitative results is through causal research and test marketing. In both cases, you present participants with a cause and record the effect. An example of this might be a taste test in which people’s reactions to and preferences for different juice flavors are recorded. Given the limited resources of many start-ups, test marketing is a great way to make sure your product works before you start investing in its distribution.

Choose a Sample

Next, you need to determine the sampling method. In terms of research, your sample refers to who you will survey and how many people you will include. In most cases, you will want a sample that reflects your target market, especially if you are trying to figure out your ideal customer’s interests and how to get them to buy your product. Untargeted samples can be useful when trying to figure out who your target market might be, but they aren’t an efficient way to get to know your ideal customer.

Generally speaking, larger samples provide more accurate data, although entrepreneurs should not feel like they need to survey everyone in a market. For example, if you have a list of 5,000 contacts, you might choose to contact 500 people who would be representative of the total group of contacts. Surveying all your population could be time consuming and expensive, so choosing a subset of the right people can yield good results. The sample must be large enough to be statistically significant, meaning that the relationship between variables is not a result of chance. The sample can then show you an accurate depiction of a specific phenomenon.

While random samples can be useful for some types of research, many entrepreneurs intentionally choose their sample participants based on economic and ethnographic factors to make sure they accurately reflect the nature of the demographic they seek to understand.

Collect Data

Once you’ve identified your research goals, chosen your design, and determined your sample, you are ready to start collecting data. There are various methods of conducting primary research. The data may be collected through observation and taking notes. For example, if you are trying to figure out if your store layout is yielding the most productive sales, you can observe traffic flow and note what people look at and what they actually purchase. Interviews can also help secure open-ended answers. You might interview potential customers on what they think is the best way to communicate with them and what they like about certain competitors’ products. This can help you obtain additional options that you may not have thought to add on a survey, which is another way to get aggregate data. Surveys are very helpful because you can ask question to current or potential customers about your product, competitors’ products, customer service, and any other information you may seek to create or improve your business. They are an easy way to collect large amounts of data from many customers, and they allow you to calculate responses. Online tools are particularly useful in providing repositories of data that can be later exported to other analytical tools such as Excel or SPSS.

Regardless of what research technique you use, be on the lookout for data collection errors. Recording the wrong answers, failing to convey the right instructions to participants, or having to translate on the fly can all create biases that skew the answers and give you inaccurate results.

Analyze Data

Once you collect your data, the next step is to make sense of it. How you analyze the data depends largely on what you want to get out of it. Typically, you will be looking for patterns and trends among the answers. Data analysis is a field unto itself, and when complex analysis is required, seeking the assistance of experts is often worth the extra cost. You can find experts within research marketing firms that specialize in collecting and analyzing data for businesses. These can be found online or through local business organizations, such as chambers of commerce.

Results and Next Steps

At this stage, the entrepreneur seeks to reconcile the results of their examination with the goals of their research. For example, if you were doing exploratory research about a potential product you wanted to bring to market, now would be the time to ask questions such as whether the research suggests market potential. Similarly, if the goal was to figure out what customers like about competing products, now would be the time to list those results and determine whether they are worth incorporating into your product. Regardless, it is important to be open to what the data say, even if they indicate results that are contrary to what you were hoping for. Research should be an opportunity for growth and a roadmap for the refinement of your idea.

Secondary Market Research

Secondary research is research that uses existing data that has been collected by another entity. Oftentimes, these data are collected by governmental agencies to answer a wide range of questions or issues that are common to many organizations and people. Secondary research often answers more general questions that an entrepreneur may have, such as population information, average purchases, or trends. If there is a specific question that cannot be answered, such as how many people would be interested in a new product with certain attributes, then primary research will have to answer that. While some of this kind of research must be purchased, much of it is free to the public and a good option for entrepreneurs with limited financial resources. Some commonly used sources for free data include the US Census Bureau, Fact Finder, Pew Research Center, Current Population Survey, and the Small Business Administration (SBA). People with access to university libraries can usually access additional research for free, so be sure to check with your librarian – they are an invaluable resource!

Other useful resources are trade organizations that provide information about specific industries, as well as newspapers, magazines, journals, chambers of commerce, and other organizations that collect local, state, national, and international data. Resources such as these can provide information about everything from population size to community demographics and spending habits. Table 7.1 lists several free databases that are rich sources of information.

Table 7.1 Sample of Databases for Secondary Research

| Database | Information | URL Address |

| Census Bureau | Economic, demographic, geographic, and social data | https://www.census.gov/ |

| American Community Survey | Updated census data | https://www.census.gov/programs-surveys/acs/ |

| Pew Research Center | Fact tank that surveys trends, issues, attitudes, and demographics | http://www.pewresearch.org |

| Pew Hispanic Center | Surveys on Hispanic trends, demographics, and issues | http://www.pewhispanic.org/ |

| Current Population Survey | Monthly survey of US households on labor data | http://www.bls.gov/cps/home.htm |

| IBISWorld | US industry trends | http://www.ibisworld.com |

| FreeDemographics | US demographic and business data | https://freedemographics.com/ |

While free sources can provide a lot of information, their research tends to be less specific than that by sources that charge for their data. Companies such as Nielsen, Forrester, and Claritas can provide more detailed information about specific behaviors on media use, lifestyle choices, specific product consumption, geographic segmentation data, and others. Table 7.2 lists some sources for this research.

Table 7.2 Additional Sites for Secondary Research

| Site | Information | URL Address |

| Nielsen TV ratings | TV ratings, media, research | https://www.nielsen.com/insights/ |

| Forrester | Consumer research, trends, and insights | https://www.forrester.com/bold |

| Mintel | Consumer research, trends, and insights | https://www.mintel.com/ |

| Neilson Scarborough | Consumer research, trends, and insights | https://www.nielsen.com/solutions/media-planning/scarborough/ |

| Claritas | Multicultural consumer research | https://claritas.com/ |

Secondary research has the advantage of being quickly available. However, secondary research often is not specific enough to provide all the details you need to know about your idea. For example, secondary research might report how often consumers purchase shampoo, where they purchase shampoo, and what brands of shampoo they purchase. But if you want to understand the details of how people shampoo (for example, whether they shampoo then repeat, use a separate conditioner, use a combination shampoo/conditioner product, etc.), then you would want to conduct primary research. Primary research is needed when secondary research does not address the questions you want to explore while investigating your business idea.

In the end, there is no perfect way to conduct research. It all depends on what you are trying to find out and what the best approach is to do that. If you are just starting out, you may want to maximize secondary research because much of it is free. You can also try primary data collection by speaking to friends, family, and others you encounter in your local and online communities.

The lesson here is that research is important at all stages of the business—before you start your business and consistently thereafter. Markets change as new people move in or out of an area, styles and preferences change over time, and new technology can radically impact what customers want to buy. We all know of businesses like Blockbuster or Xerox that ignored evolving technology, to their own detriment. Constantly tracking changes in the external environment and competitive arena is an ongoing activity that supports the continued success of the venture.

Researching to Verify Entrepreneurial Opportunity

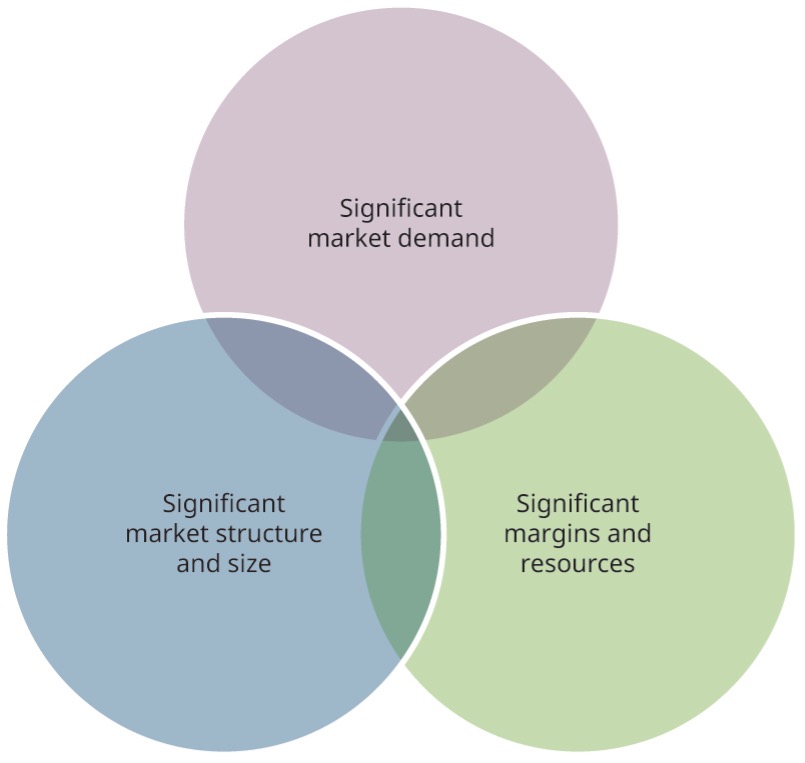

One of the most common questions guiding an entrepreneur’s research is whether now is a good time to start their business. This question of timing can be addressed by determining whether their idea is merely interesting or if it fits the criteria of being an entrepreneurial opportunity. In particular, an idea can be considered an opportunity when the following criteria are met (see Figure 7.2):

- Significant market demand

- Significant market structure and size

- Significant margins and resources to support the venture’s success

Significant market demand means that the idea has value by providing a solution to a problem that the target market is willing to purchase. This can result from a new product or service that fills an unmet need, a lower price, improved benefits, or greater financial or emotional value.

Significant market structure and size involve growth potential and drivers of demand for the product or service. Barriers to entry are manageable, meaning that entering the industry or creating a new industry is not exceptionally difficult. If the industry already exists, there must be room within the industry for your venture to gain market share by providing a value that creates a competitive advantage.

Significant margins and resources involve the potential for achieving profit margins at a high-enough level that the work of starting the venture (including the entrepreneur’s time and energy) is worth the risks involved. If the operating costs are too high and the profit margin is too low, it is important to analyze whether the idea is truly feasible. Significant margins also include the capital requirements—how much money is needed to start the venture—as well as the technical requirements, the complexity of the distribution system, and similar resources. This will be discussed further when we get to our consideration of financial modeling and business planning.

Figure 7.2 Criteria for an Entrepreneurial Opportunity

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Determining whether an idea has significant market demand, significant market structure and size, and significant margins and resources to support the venture’s success represents the most basic concerns when screening a business idea as an entrepreneurial opportunity.

Keep in mind that these three criteria are based partially on creating a for-profit venture. In a for-profit venture, significant market structure and margins relate to the expectation that the venture will have significant sales with significant profit margins to sustain and grow. If your entrepreneurial venture is focused on solving a societal problem, you also want to know that the identified problem is realistic and that there is a need for solving it.

What should you do if your idea does not fit these criteria – significant market demand, market structure and size, and margins and resources – and your passion to develop the idea into an opportunity and new venture is still strong? This is also part of the entrepreneurial process. You, as the lead entrepreneur, are charged with the task of identifying the obstacles to turning your idea into an opportunity and what actions are necessary to overcome these. This could mean adjusting the idea, adding new features, or even removing some features. Adding new features should focus on increasing the value or benefit offered by the product or service, or creating a tighter alignment with the needs of the target market. Removing features could decrease the production costs or even the complexity in using the product.

Assessing Market Size and Validating Customer Demand

One common goal of market research is the identification of a market opportunity, or an unmet need within a target demographic that might be fulfilled by an existing or new product. Looking for gaps or unmet needs within a marketplace is one way to identify market opportunities for both goods and services. For new products, this entails looking at the needs of a demographic, identifying which of those are not being met, and determining what kind of product could fulfill it. Based on our earlier discussion of secondary research, there are many places where data can be found online or offline to determine these needs.

Similarly, you might identify common local, national, or global problems through observation and directly interacting with potential customers, and try to create services that would solve them. Social, economic, technological, and regulatory changes all have the potential to create market opportunities.

For example, when inventor David Dodgen saw the suffering that Hurricane Katrina had left behind, he saw an unmet need that this event had created. By witnessing the disasters, he realized that when hurricanes or other disastrous events strike, they can contaminate the water supply in a region or city or prevent access to clean water. As a result, he created the AquaPodkit, a plastic container that can temporarily store fresh water for weeks at a time in the event of an emergency. The Federal Emergency Management Agency (FEMA) recommends that people fill their tub if they feel that there may be a chance that water will be scarce. Oftentimes, tubs can be dirty, and people may not have the time to clean them. With this in mind, Dodgen developed a plastic lining, or bathtub bladder, which is manufactured in the United States and is safe to drink from, together with a pump that helps seal and open the plastic when the water is needed. This kit can hold up to 100 gallons of fresh water in the tub and has proven successful; it has also been featured by CNBC, Entrepreneur, and the New York Times.

Link to Learning

View this video about the AquaPodkit to learn more. Dodgen also created smaller bags and pumps that can be stored anywhere, not just in the tub.

Sometimes unmet needs are not uncovered immediately. One way to better understand a market’s opportunities is to conduct a market analysis, which is an analysis of the overall interest in the product or service within the industry by its target market to determine its viability and profit potential. Customer validation is the process of verifying that a specific product is needed in a target market. This can be done by conducting formal or informal interviews or surveys with potential customers to gather their feedback. Dropbox is an example of a company that conducted customer validation over and over until they created a product that could work with a mainstream audience.

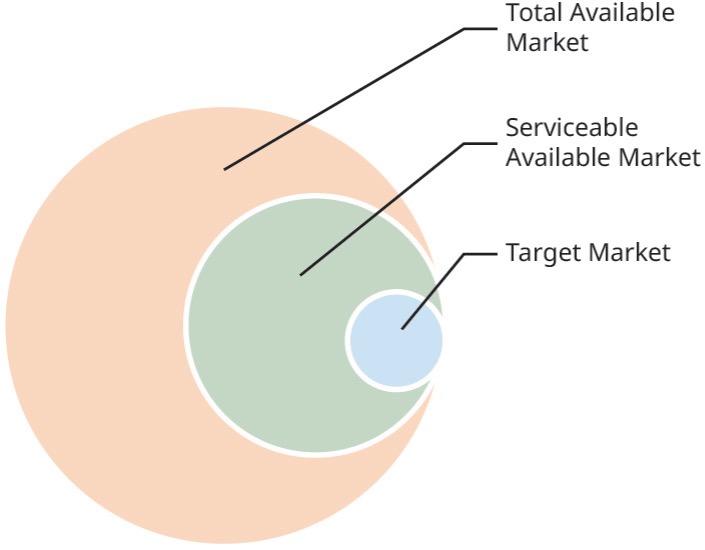

In addition to identifying competition and determining growth and profit potential, a good market analysis will identify the total available market (TAM) for a specific product, which is the total perceived demand for a product or service within the marketplace. It will also identify the serviceable available market (SAM), which is the portion of the market that your business can serve based on your products, services, and location. Entrepreneurs must focus on the target market within the TAM and the SAM and allocate resources to attract customers who can be satisfied by the value proposition (see Figure 7.3).

Figure 7.3 Assessing Market Size

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

To calculate this, let’s return to our water bottle example. Let’s say that you are trying to figure out what your target market is based on this concept. To calculate the TAM, you would look at the whole industry and determine the total number of customers available for water bottles or total revenue available. To find the number, you can look up the industry numbers for the category on databases such as IBISWorld, mentioned earlier, or any other data available through the World Bank or World Factbook to see the potential number of customers or revenue. This is called the top-down approach, as you are looking at macroeconomic factors to determine an industry’s potential.

Another way to calculate the TAM would be by using the bottom-up approach, which involves counting local market sizes and figuring out the competitors’ number of customers. After collecting this information, then all the local markets would be added up and multiplied by the average amount they spend on the product per year. Since your company cannot service all markets, the next step is to figure out the SAM. You could estimate the number of customers you can service by splitting the market into those you can service given your product characteristics and geographic, demographic, and cultural factors, among others.

Finally, considering the constraints of the company and strength of the competition, you would determine your focused target market to avoid wasting valuable resources marketing to people who are generally not interested in buying your product. As an entrepreneur, you want to segment the market and figure out if there are possible pockets of people that you can serve. Segmenting, targeting, and positioning (STP) will help you figure out who is your best customer and will allow you to allocate your resources so that you can more effectively serve that customer. Let’s look at these processes now.

Segmenting means that you separate the total population by homogeneous groups of people that have similar tastes, backgrounds, lifestyles, demographics, and even culture. You may segment along lines such as age ranges, gender, ethnicity, line of work, earnings, or activities. There are many ways to separate these groups to choose the right one for your business.

The next step is targeting. You select a target based on their ability and willingness to buy. As stated earlier, a target market serves to specify which group of the total market you will serve and how you will position yourself to distinguish your company or product from your competitor.

Positioning involves developing a statement of how you want the customer to perceive your company, good, or service (i.e., your value proposition). For example, ModCloth is an online indie retailer that sells vintage, or vintage-looking, trendy, fun clothing that appeals to the global consumer who wants to be stylish. Another example is Wag! which positions itself as the app that lets the pet owner look for a walker on demand. Kind of like the Uber for dogs who want a walk when their owners can’t take them.

Competitive Analysis

Conducting a competitive analysis helps you focus your idea and identify your value proposition and competitive advantage. A competitive analysis should provide the entrepreneur with information about how competitors market their business and ways to penetrate the market by entry through product or service gaps in areas that your competitors do not serve or do not serve well. More importantly, competitive analysis helps the entrepreneur develop a competitive edge that will help create a sustainable revenue stream.

For example, a big company like Walmart primarily competes on price. Small companies typically cannot compete on price, since the internal efficiencies and volume sales available to large corporations like Walmart are not available to small companies, but they may be able to compete successfully against Walmart on some other important variable such as better service, better-quality products, or unique buying experiences.

When conducting a competitive analysis, be sure to identify your competitors by product line or service segment. For an entrepreneur, this activity can be difficult when the industry does not yet exist. In this case, the competitive analysis might need to focus on substitute or related products, rather than direct competitors. Remember, there is ALWAYS competition – even if it’s the status quo. Below, a few tools that can be used in competitive analysis are discussed further.

Competitive Analysis Grid

The competitive analysis grid should identify your competitors and include an assessment of the key characteristics of the competitive landscape in your industry, including competitive strengths and weaknesses and key success factors. Table 7.3 provides an example of what a competitive analysis might look like for a bicycle shop in a tourist locale, by capturing some of the main aspects of key competitors within that particular market.

Table 7.3 Competitive Analysis Grid for Sid’s Cycle Shop in Branson, Missouri

| Key Characteristics | Sid’s Cycle | City Cycle | SpokeMasters | Target |

| Strengths | Product knowledge, Repair service | Repair service | High quality, Top brands | Price, hours (open seven days per week and online) |

| Weaknesses | Limited selection | Poor customer service | Pricing, no entry-level products | Low-end quality, no repair facilities |

| Product Quality Level | Low-middle | Middle-high | High-end | Entry-level |

| Price Point | Middle | Middle-high | High price | Lowest price |

| Location of the business | Suburban strip-mall on busy highway | Outskirts of town on route 280 | Downtown side street | Branson Mall |

| Promotion | Weekly ad in local newspaper, some radio and Internet/social media | Advertising in local paper during season, Internet/social media | Sponsors major bike race in area, Internet, social media | Advertises online and in Sunday newspaper (seasonally), Internet) |

As you complete an analysis for your venture’s competitors, you should identify what contributes to the competitor’s success. In other words, why do people purchase from the company? Some possible reasons include no nearby competitors, lower prices than competitors, a wider variety of products, offering services not offered elsewhere, or branding and marketing that appeals to the target market. Your analysis should inform you of a combination of key success factors within the industry (i.e., what it takes to be successful in that particular industry) and of what your competitors are not offering that is valued by your target market.

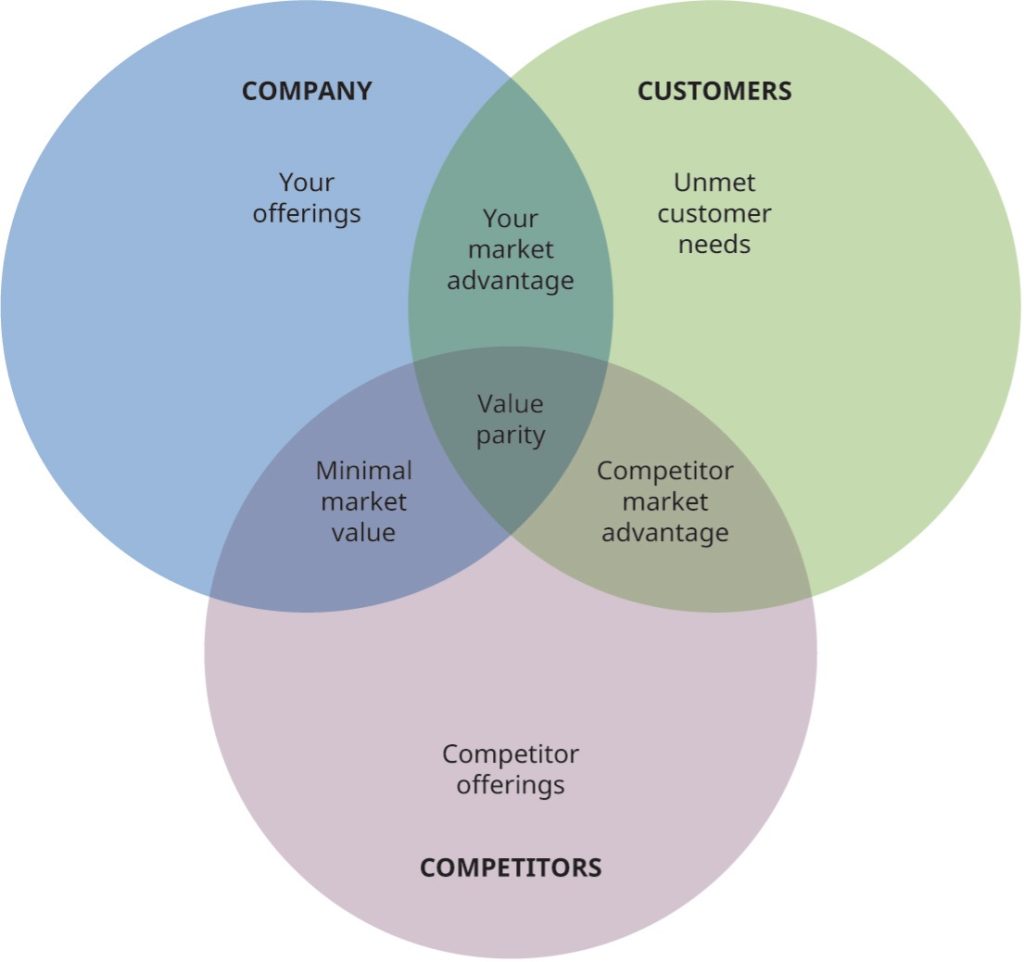

Three Circles Tool

Another tool that can be used in competitive analysis is the three circles tool (Figure 7.4). The three circles competitive analysis tool helps to identify where there is overlap between your venture and the competition as well as where there may be a gap in the market that a new venture could fill. The overlaps identify points of parity, which are the areas where competitors offer the same value as your venture. This tool also aims to facilitate the identification of competitors’ strengths, areas of unmet customer needs, and how unique your competitive advantage is within the industry (by identifying values or features not offered by competitors). Gaps in value or offered services can help an entrepreneur to identify their competitive advantage and value proposition.

Figure 7.4 Three Circle Analysis

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

SWOT Analysis

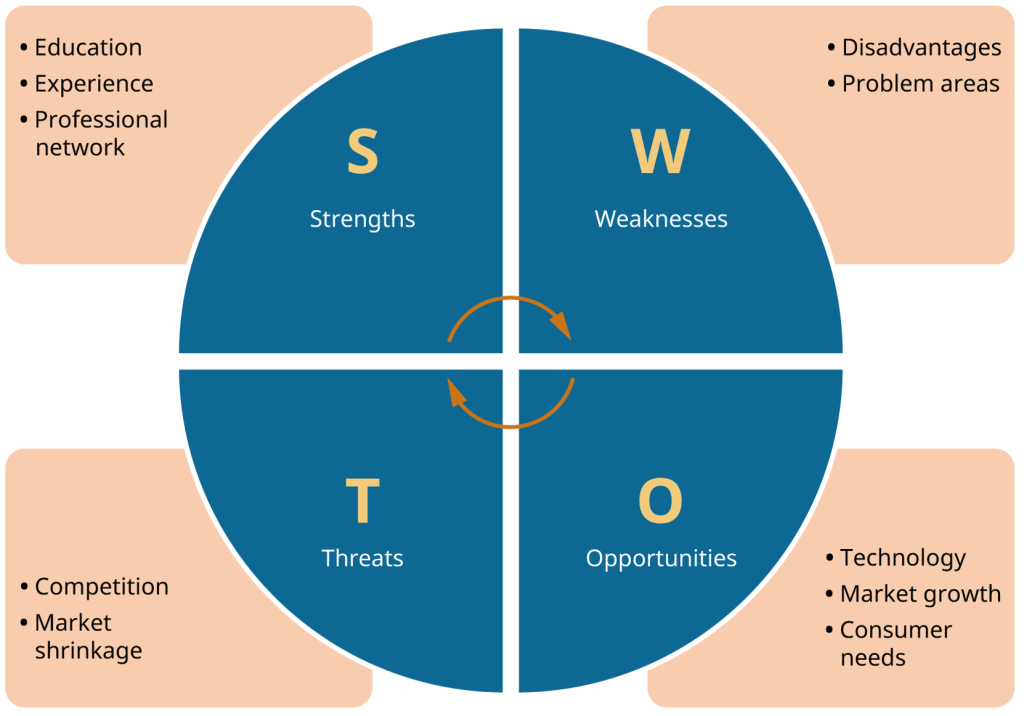

Another frequently used tool is a SWOT analysis (strengths, weaknesses, opportunities, and threats). Strengths and weaknesses are internal to the entrepreneur, while opportunities and threats are external factors (see Figure 7.5). Strengths are capabilities and advantages of the entrepreneur/venture, including education, experience, and personal or professional contacts. Weaknesses are disadvantages of the entrepreneur/venture, which could include lack of knowledge or experience. Opportunities are positive events that the entrepreneur can develop to their benefit. This could include development of new technologies, changes in consumer tastes and preferences, market growth, and new laws and regulations. Threats can be anything that could potentially harm the business or prevent the business from becoming successful, such as competition, negative changes in economic conditions, and new laws or regulations.

A SWOT analysis focuses on evaluating your venture’s potential and builds on the knowledge gained from the competitive analysis grid and the three circles. You will need to identify the strengths that your venture will need to support the competitive advantage identified through the competitive analysis tools. The weaknesses can be identified based on your current and foreseeable expectations. For a new venture, the opportunities and threats sections are based on current factors in the external environment that come from your market research. In this context, opportunities are facts, changes, or situations within the external environment that could be favorably leveraged for the venture’s success.

Figure 7.5 SWOT Analysis

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

PEST Analysis

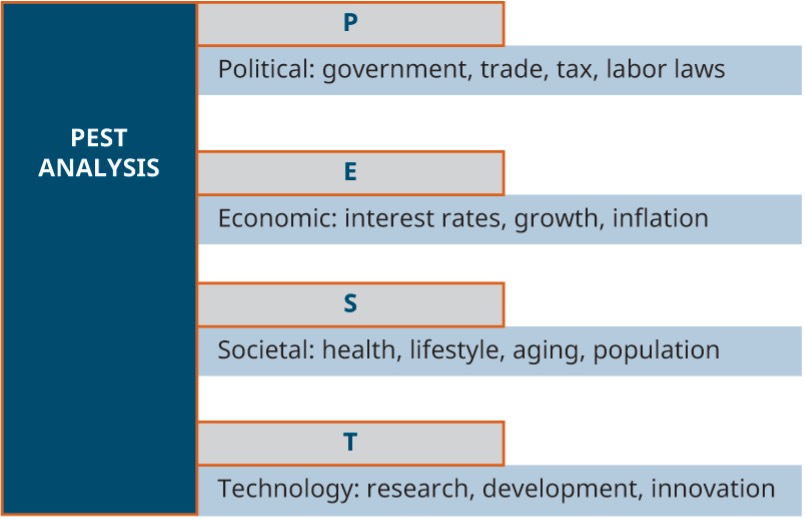

A tool that can be useful in developing the opportunities and threats section of a SWOT analysis is called the PEST analysis (political, economic, societal, technology). In this analysis, each of these categories should be completed with relevant facts related to your entrepreneurial opportunity (see Figure 7.6). After completing the PEST analysis, you can then determine if the factors identified, which may represent favorable or unfavorable external environmental influences facing a venture, can be placed in the opportunity or threat section of the SWOT.

Figure 7.6 PEST analysis

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Attribution: Copyright Rice University, OpenStax, under CC BY 4.0 license

Social Media’s Role in Research

For almost all new business ventures, two key issues related to research are time and money. Large-scale research projects can take months or longer and cost a significant amount of money. Social media can offer some opportunities to overcome these concerns.

Ray Nelson, writing for Social Media Today, reports several ways that social media can provide speedy, low-cost market research: tracking trends in real-time, helping the entrepreneur “learn the language” of their potential customers, discovering unnoticed trends by engaging consumers, and performing market research using a very cost-efficient means. If the entrepreneur can perform social media research on their own, the cost will primarily be in terms of time. But the time it will take to conduct research through social media platforms such as Facebook, Twitter, and Instagram is usually well spent.

This research should include learning the value proposition of competitors, understanding their competitive advantage, and identifying what the customer values, which can be rather difficult. For example, before Amazon recognized that people are busy, were we aware that we wanted faster check-out processes for making purchases? Or were we aware that we wanted the package delivered to our home to be easier to unwrap? And yet, if we asked Amazon shoppers what they value in shopping at Amazon, we will receive answers that support an easier and faster process.

Another technique would be to read through customer reviews on sites like Google or Amazon (or other companies related to your entrepreneurial venture) to find out what customers like and don’t like about existing products and services. You can also develop your own surveys on a site like Qualtrics and send them to customers and prospective customers. This usually works when you can send them to persons who have a strong interest in the offering or issue rather than randomly sending out surveys.

Exercise: Researching Target Markets with Census Data

Practice conducting research by going to www.census.gov and two other sources to identify a specific target market for a product that interests you. Include the target market’s:

- Disposable income (i.e., whether the target market has sufficient disposable income to purchase this product)

- Demographics

- Psychographics (i.e., the combination of buying personality habits and behaviors)

- Preferred channels (i.e., how you as the entrepreneur can reach this target market)

Market Research to Avoid Failure

Many estimates indicate that half of all new businesses will no longer exist within the first five years. See Table 7.4 for a list of the most common reasons for small business failures.

On the surface, this fact can be daunting. However, there are many reasons why a business no longer exists that can reflect a positive outcome, such as the sale of a business or a merger with another business. Another example is when an entrepreneur intentionally starts a venture knowing that there is a short-term timeline for success, with the expectation that new technology will replace the gap that the venture originally filled.

Table 7.4 Top Reasons for Startup Business Failure

| Reason | Description |

| Low sales | Entrepreneurs may have overestimated sales, assuming they could take sales away from established competitors. |

| Lack of experience | Running a business is hard, and a new business can be especially challenging, as it is difficult to prepare adequately for the unexpected. |

| Insufficient capital | When calculating how much money you will need to start your new business venture, be sure to account for the time it will take before your business breaks even and be sure also to allow for some contingency funds for when the unexpected happens. |

| Poor location | For some types of businesses, location is critical. Of course, location may be less important for a home-based business and not at all important for an Internet business. |

| Poor inventory management | Too much inventory results in the business becoming cash-strapped and unable to buy advertising or other important goods and services. |

| Overinvestment in fixed assets | Especially when starting a business, it is usually less expensive to lease or purchase used equipment, thereby saving cash for meeting operational expenses. |

| Poor credit arrangement management | Start your venture small and limit the amount of money you need to borrow. Work with your banker from the beginning by sharing your business plan and vision for the business with the banker and, most important, show that you are proactive in planning for when you will need to borrow money. |

| Personal use of business funds | The owner should pay him/herself a minimal salary and not dip into business funds. If the business has done well, the owner will earn additional funds at the end of the year. |

| Unexpected growth | Surprisingly, some businesses fail because the business owner cannot manage growth. Growing a new venture, especially if the growth is at a higher rate than expected, can create surprising challenges. For example, if creating a product, you need to consider the capacity of the factory where you are producing the product. If you are at 100 percent capacity and your orders increase, you will need to think about what actions can support this increase in demand. If you cannot meet the demand, you will have unhappy customers and negative publicity that will reflect negatively on your leadership and managerial skills. Your lack of planning for this surge in sales may open opportunities for someone else to start a competing business. |

| Competition | Many small business owners underestimate their competition. Remember, if there is money to be made, there will be competition! Larger competitors can beat you every day of the week on price, so find another way to challenge competitors. |

Understanding some of the factors that lead to business failure can help you be more aware as you research your idea and opportunity. Good research can help you avoid your business becoming a statistic. Most entrepreneurs are not big risk-takers but understand that there are no guarantees in starting a new business venture. Instead, entrepreneurs tend to take calculated business risks based on the best research they can gather. At some point, however, an entrepreneur recognizes that despite all the good research they have gathered, they still need to take a leap of faith when starting their new venture.

When you have a business idea that you have been researching and find that there is a large enough market that has a need that your idea meets, that this target market has the willingness and ability to satisfy the need through purchasing the provided solution, that you have access to the necessary resources to build an infrastructure for your business, that you have the right mix of products and services with a sound value proposition, and that you can secure sufficient funding to start, then you have a real opportunity on your hands. This chapter has introduced you to all these concepts, but we will continue to explore them further in future chapters.